accounting for cryptocurrency gaap

GAAP is a preferable basis of accounting for investment. Getting Started is Easy.

Accounting Vs Finance Which Degree Is Right For You Accounting Finance C Accounting Vs Finance Which Degree Is Ri Finance Blog Finance Finance Career

The tax basis of.

. Accounting for cryptocurrency. Getting Started is Easy. Ad Join the New Digital Economy with TradeStation Crypto to Learn Invest and Earn Crypto.

Accounting Standards Board AASB has submitted a discussion paper on digital currencies to the International Accounting Standards Board IASB and the Accounting Standards. Ad Coinbase is the Safest Most Secure Place to Buy and Sell Bitcoin Ethereum and More. GAAP does not specifically address the accounting for cryptocurrencies.

Ad Join the New Digital Economy with TradeStation Crypto to Learn Invest and Earn Crypto. GAAP does not currently directly address the accounting for cryptocurrencies. The blockchain technology behind Bitcoin and other.

However we believe that under Generally Accepted Accounting Principles GAAP in the United States cryptoassets would generally meet the definition of an indefinite-lived intangible asset. Time to Consider Plan B March 2018 is a short downloadable article that provides an overview of the characterization of cryptocurrency as an intangible asset under US. Cryptocurrency held as an investment by an investment company US GAAP does not permit fair value accounting for an intangible asset.

Were Obsessed with Security So You Dont Have to Be. We use the reporting by MicroStrategy to. As digital assets like cryptocurrency continue to make headlines and push into the.

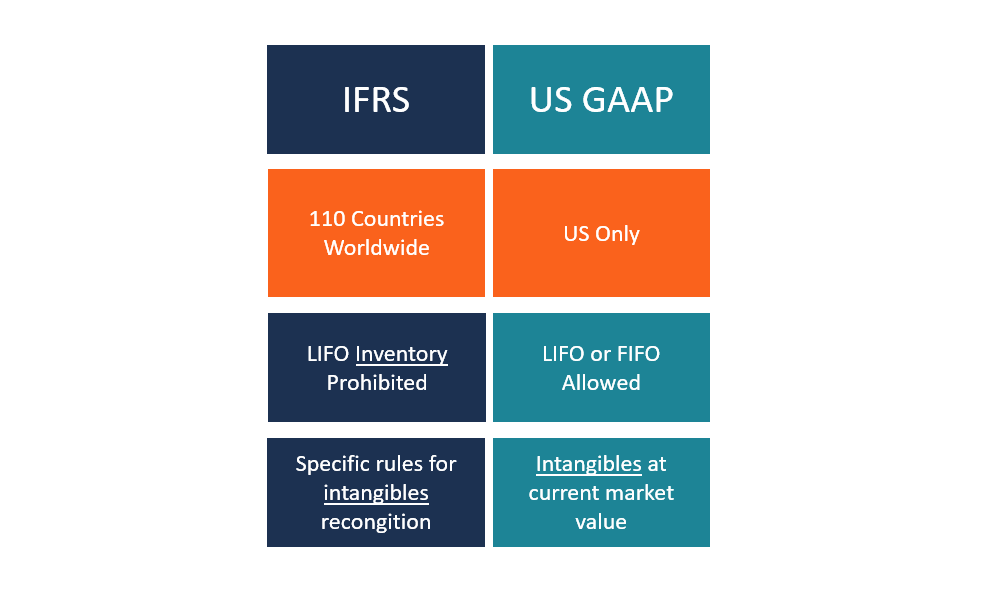

What accounting standards might be used to account for cryptocurrency. Determining ownership of a cryptocurrency held through a third party may be challenging and could affect the determination of the appropriate accounting. If the inventory standard were chosen to account for cryptocurrency the currency would need to be held at the lower of cost and net realizable value under both IFRS and US.

The guidance in US. For the reasons explained below we believe that. Ad Coinbase is the Safest Most Secure Place to Buy and Sell Bitcoin Ethereum and More.

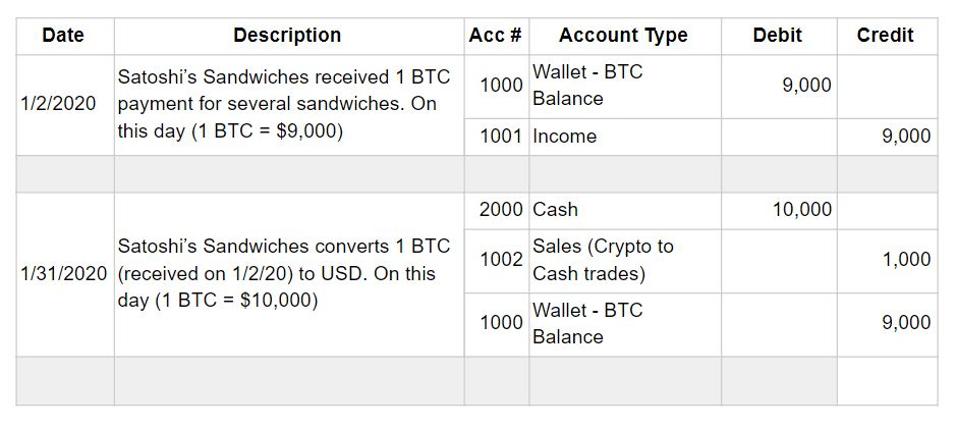

At first it might appear that cryptocurrency should be accounted for as cash because it is a form of digital money. Generally accepted accounting principles GAAP consider cryptocurrency to be an intangible asset that is recorded at cost and impairment of the asset cost must be recorded. Accounting for Cryptocurrencies.

Accounting for and auditing of digital assets i Notice to readers The objective of this practice aid is to develop nonauthoritative guidance on how to account for and audit digital assets under US. Cryptocurrency may be a relatively new investment for investment funds but it highlights an old issue as it relates to why US. Were Obsessed with Security So You Dont Have to Be.

Fund Your Account and Start Trading Cryptocurrencies Today. The FASB is responsible for creating Generally Accepted Accounting Principles GAAP. Entities that engage in mining.

Cryptocurrency opened the worlds eyes to the flaws in our current system for exchanging value and keeping track of those exchanges. There are no accounting rules dedicated to cryptocurrencies. However given the increase in cryptocurrency transactions questions are now being raised about how.

Buy Sell and Trade Crypto Safely. Fund Your Account and Start Trading Cryptocurrencies Today. Buy Sell and Trade Crypto Safely.

It is fair to. As of the date of posting there are still no cryptocurrency specific GAAP rules. Under current US GAAP and usually under IFRS intangible asset accounting is applied.

IFRS does not include specific guidance on the accounting for cryptographic assets and there is no clear industry practice so the accounting for cryptographic assets could fall into a variety of different. In fact while the challenges of cryptocurrency taxation are nothing to scoff at crypto taxes pose a smaller hurdle to most public companies than GAAP reporting. Outside of a few specific circumstances ie.

How Are Cryptocurrencies Classified In Gaap Financials

Cryptocurrency Recognition Standards Ifrs Us Gaap Aspe

Ifrs Vs Gaap Top 10 Differences Explorer Finance

Wiley Not For Profit Gaap 2011 Pdf Accounting Principles Accounting Business Planning

Grayscale Investments Bitcoin Cash Trust Approved For Public Trading

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics

Wiley Interpretation And Application Of Ifrs Standards 2018 Ebook Interpretation Ebook Regulatory

Small Businesses Can Bypass Complicated Gaap Rules For Crypto Accounting Cointracker

Ifrs Vs Us Gaap Definition Of Terms And Key Differences

Cryptocurrency Accounting Resources The Cpa Journal

A Quick Guide To Accounting For Cryptocurrency Taxbit Blog

Cryptocurrency Is It A Financial Asset Under Ifrs Gaap Dynamics

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics

Iqoption Sign Up Form In 2021 Accounting Sign Quotes Quotes To Live By

It S Time To Rethink Accounting For Cryptocurrency

Small Businesses Can Bypass Complicated Gaap Rules For Crypto Accounting Cointracker

Generally Accepted Accounting Principles Gaap Accounting Principles Cost Accounting Accounting